Pointing to costs of the Affordable Care Act (ACA), some employers are

dropping spouses from their group health plans next year. United Parcel Service,

for instance, generated a flurry of headlines last month following its decision

to jettison roughly 15,000 spouses from coverage in its nonunion, white-collar

workforce in 2014 — a move that UPS says will save the company roughly $60

million a year. Health benefits experts contacted by HRW say this trend

is small at the moment, but likely will grow as employers look for new ways to

save money in the face of rising costs attributed to the reform law. If the

trend gains traction, others note it could boost enrollment in plans on the

exchange.

In making its decision, UPS said it had considered what other companies were

doing, as well as the impact on employees. gBased on market data, 35% of those

companies plan to exclude working spouses eligible for their own employerfs

coverage in 2014,h the company said in a July memo.

gSince the [ACA] requires employers to provide affordable care coverage, we

believe your spouse should be covered by their own employer — just as UPS has a

responsibility to offer coverage to you, our employee,h the memo asserted. UPS

said that employees affected by the new policy could save $1,600 a year, the

difference between the projected premium in 2014 for employee-plus-family

coverage versus employee-and-children coverage under the traditional option.

In a similar move, the University of Virginia (UVA) last month said that

starting in 2014, gspouses who have access to coverage through their own

employer will no longer be eligible for coverage under [UVAfs] plan.h UVA cited

provisions of the ACA that are projected to add $7.3 million to the cost of the

universityfs health plan in 2014 alone.

gIf the university made no changes to address rising costs or the impact of

the [ACA], employee premiums would have risen a projected 12% to 13% this year,h

UVA said in an Aug. 21 news release.

Dropping Spouse Coverage Is Growing Trend

Such examples represent the leading edge of a movement that is small but

growing, says an employee benefits expert.

gThe trend has several flavors,h says Ed Fensholt, an attorney who is senior

vice president and director of compliance services at employee-benefits firm

Lockton Companies. gDrop spousal coverage altogether, treat a spouse as

ineligible if he or she has coverage available elsewhere, or continue to treat

the spouse as eligible but reduce or eliminate the employer subsidy toward the

spousefs coverage.h

Employers are grappling with a gmeaningful array of new costsh due to the

ACA, Fensholt tells HRW.

The costs include those of the ACAfs benefit mandates, such as coverage of

adult children, elimination of annual and lifetime benefit maximums, and

cost-free preventive care, he says, maintaining that together they add about 5%

or more to plan costs. Furthermore, new ACA-imposed taxes and fees on the

insurers and plans are being paid directly or indirectly by employers, and will

add roughly 4.5% in costs to both insured plans and self-insured plans in 2014,

Fensholt explains. And the biggest-ticket item, he adds, is the cost of

extending coverage to nearly all full-time employees of firms with more than 50

workers under the employer mandate, which has been delayed until 2015 (HRW

7/22/13, p. 1).

gThe estimated cost of [these provisions] can be in the millions, depending

on the size and industry sector of the employer,h Fensholt says of the effect on

individual employers.

Benefits consulting firm Mercer LLC also is tracking what employers are doing

regarding spouses.

In Mercerfs 2012 National Survey of Employer Sponsored Health Plans, which

represents data from nearly 2,810 employers of all sizes, 6% of employers

reported excluding spouses from coverage, and another 6% reported charging a

spousal surcharge. This represents a total of 12% of employers with some type of

special provision for spousal coverage, says Tracy Watts, a senior partner in

Mercerfs Washington, D.C., office.

The reform lawfs new costs are part of the calculation, she adds.

gThe ACA includes many epatient-protectionf requirements that medical plans

must comply with. And, of course, each of the patient protections has a price

tag attached,h Watts tells HRW of new fees and taxes that go onto

effect next year. gFor 2014, employers are facing cost increases of 3% to 5%

just for the ACA requirements on top of medical trend at 7% to 8%,h she

explains. gWhen faced with double-digit cost increases, some employers will have

to make tough decisions.h

Large Employers Look to Exchanges for Relief

The countryfs largest employers are eyeing the insurance exchanges as an

option to ease those tough decisions.

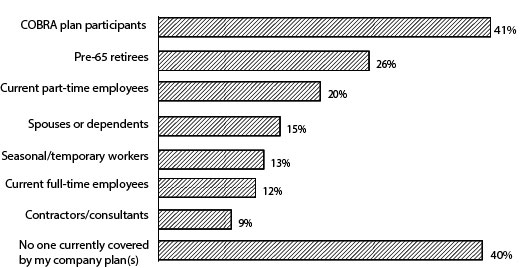

Large employers are expecting a 7% rise next year in the cost of providing

employee health care benefits, according to a survey released Aug. 28 by the

National Business Group on Health (NBGH), a coalition of large employers. The

survey also found that the insurance exchanges could be a viable option for

certain populations that the employers now cover (see chart, p. 3).

One of those population groups is spouses and dependents. The survey finds

that 15% of large employers expect spouses or dependents who now are being

covered under their plans to choose public health exchanges for coverage.

This doesnft surprise NBGH President and CEO Helen Darling.

Moving spouses off an employerfs plan could gsave a lot of money,h she tells

HRW. Coverage of spouses and families can cost employers tens of

thousands of dollars more than does just providing coverage for the worker

alone. Some of those costs get passed on to employees who donft have spouses,

Darling adds.

gItfs a fairness issue, a balance issue,h she says of decisions to remove the

coverage for spouses.

One growing trend to address this fairness issue is by placing a surcharge on

spousal coverage. Today, 20% of employers levy a surcharge of roughly $100 per

month on spouses who do not use their own employerfs coverage, according to the

18th Annual Towers Watson/National Business Group on Health Employer Survey on

Purchasing Value in Health Care, released in March. An additional 13% said they

plan to do so in 2014.

IT services company Xerox Corp., for example, recently said it will charge

employees $1,500 if they add a working spouse to their plan, up from its current

$1,000 penalty for spouses, according to an Aug. 20 article in USA

Today.

While such announcements generally affect spouses who have coverage options

with another employer, some say this trend eventually could be applied to

spouses who stay at home or work at places that donft offer coverage.

The employer mandate under the ACA ghas been construed to not require

employers to offer anything to a spouse,h explains Fensholt.

In some cases, he adds, it is better to have no coverage from a spousefs

employer than to have unsubsidized or lowly subsidized coverage. gThatfs because

if an employer offers an employee minimum value and affordable coverage, and

offers at least some coverage to a spouse, the spouse is deemed to have an offer

of minimum value and affordable coverage, and is frozen out of exchange-based

subsidies to buy insurance,h he says.

But implementing policies that exclude spousal coverage is something

employers will want to think hard about. gAre its benefits still competitive? If

not, do they need to be to attract the talent the employer needs?h Fensholt

says, as examples. gAs this trend becomes more prevalent, the adverse impact on

recruiting and retention will diminish.h

Mercerfs Watts agrees this is tricky territory. A spousal surcharge is

complicated to communicate to employees and complicated to administer, she says.

gTotally excluding spouses from eligibility is a tough message for employers to

deliver to employees,h she says.

One outcome could be an enrollment boost in plans offered on the exchanges.

gThere will likely be at least some uptick in exchange-based enrollment as

employers shed spouses from their plans,h Fensholt says.

But Robert Laszewski, president of Health Policy and Strategy Associates,

LLC, says there is no indication yet that this will be widespread. Insurers earn

more from the group market, he tells HRW, noting that the individual

market traditionally has been seen as a very poor market in terms of

profitability.

gThe real issue here is about employers being able to be competitive in

hiring skilled workers,h Laszewski says. gWe may well be on the cusp of seeing a

real dichotomy between employers who need skilled workers and employers who

donft have to compete so robustly for workers; UPS is likely in the latter

category.h

To read the UPS memo, click http://tinyurl.com/q2z6osx.

Responses of Large Employers to Survey Question About Which of Their

Currently Covered Groups Will Choose Exchange Coverage in 2014

Note: Respondents were allowed to select more than one option. Number of

responses=105.

SOURCE: National Business Group on Health, Large Employersf 2014 Health Plan

Design Survey, August 2013.

© 2013 by Atlantic Information Services, Inc. All Rights

Reserved.

Atlantic Information Services, Inc.

1100 17th Street NW,

Suite 300, Washington, DC 20036 - 800-521-4323

Copyright ©

2013 Atlantic Information Services, Inc. All Rights Reserved.